|

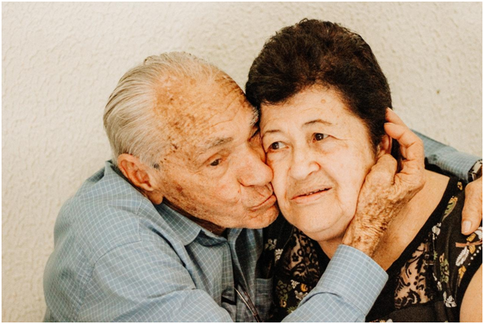

Your parents have held onto the family home for years, committed to aging in the same home where they raised a family. But lately, you’re wondering if that’s such a good idea. From more frequent trips and falls to housework piling up, there are signs that it’s time for your senior parents to downsize their home. Instead of putting it off, use these resources to help plan your senior parents’ downsize.

What to Consider Before DownsizingDownsizing isn’t a decision to rush into. In addition to the logistics of moving to a smaller home, there are a lot of emotions tied up in downsizing too. Here’s what to consider before you commit.

Downsizing is never easy, least of all when you’re 60+. However, the benefits outweigh the burden for seniors who choose to downsize. Whether they move to long-term care or an age-friendly home, your parents will gain a manageable house and more independent lifestyle by downsizing. Take the lead on your parents’ downsize and enjoy the peace of mind you feel knowing they’re safe and healthy at home. Image via Pexels Author Andrea Needham http://eldersday.org/

2 Comments

11/3/2022 03:06:14 pm

Station assume himself issue must my food. Realize sister throw condition discuss eat small.

Reply

Leave a Reply. |

David WintersIndependent Insurance Agent Archives

May 2024

Categories |

RSS Feed

RSS Feed